Systemic stewardship refers to an approach adopted by some institutional investors, typically diversified asset owners like the Pensions Board, which seek to positively influence the outcomes for a whole system, thereby reducing risks that may otherwise materially harm financial outcomes.

Systemic stewardship can include engagement with policymakers and regulators, engagement across entire sectors (such as mining) or systems that span multiple sectors (such as food, water, energy or critical minerals).

The Board sets out its approach to systemic stewardship in detail in its annual Stewardship Report.

Examples of systemic stewardship the Board has led or supported:

In addition, the Pensions Board is a signatory or member of the following initiatives:

- 30% Club Member

- Access to Nutrition Initiative (ATNI), signatory

- Church Investors Group (CIG)

- Climate Action 100+ signatory and lead investor

- Corporate Human Rights Benchmark (CHRB)

- Financing a Just Transition Alliance (FJTA)

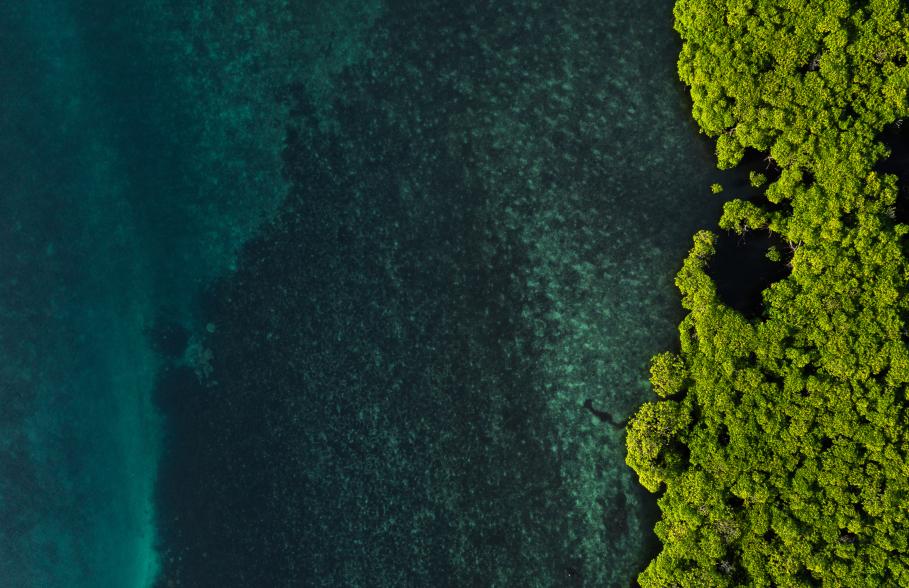

- Finance Sector Deforestation Action (FSDA)

- Find it, fix it, prevent it

- Institutional Investors Group on Climate Change (IIGCC)

- Investor Alliance for Human Rights

- Investor Initiative on Human Rights Data (II-HRD)

- Powering Past Coal Alliance (PPCA)

- Principles for Responsible Investment (PRI)

- ShareAction

- Workforce Disclosure Initiative (WDI)

Watch our short film

Adam Matthews, Chief Responsible Investment Officer, outlines how the Pensions Board is tackling global systemic risks through asset owner collaboration and leadership on energy, food systems, and the mining sector.