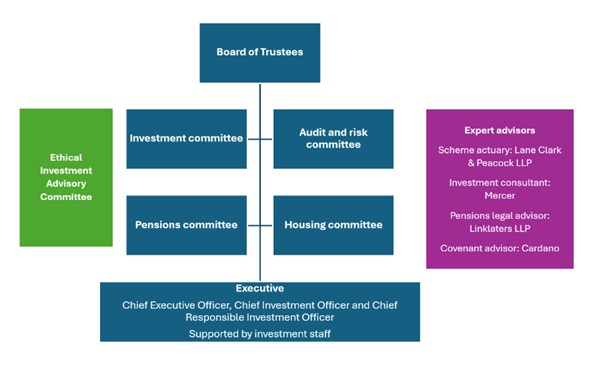

The Pensions Board is ultimately responsible for overseeing our investments and ensuring that we meet our pension liabilities.

The Board has delegated investment-related decision making to its Investment Committee. The members of our Trustee Board and Investment Committee are listed in our Annual Review and Stewardship Report.

Our Board of Trustees ensures good governance, best practice adherence and that our institution’s ethos is reflected at a strategic level and through the team’s priorities.

In addition to our Trustees and Investment Committee, the Investment Team is also supported by:

- External asset managers who we work with to manage our assets, and we carefully monitor their implementation of our financial and responsible investment objectives. Our Stewardship Implementation Framework outlines our stewardship activities and ESG-related expectations of asset managers. A full list of our asset managers can be found here.

- Our investment consultant who advises on asset allocation, manager selection and the ongoing monitoring of the Board's fund managers

- Our asset custodian. It operates a passive currency hedging program and provides an independent measure of fund managers’ investment performance.

Our stewardship and ethical investment activities also benefit from close collaboration with other institutions and individuals, from other Church institutions to academics, data providers, NGOs, and other investors.